Distressed M&A and Insolvency Situations

Distressed M&A and insolvency situations have several similarities like generally the high time pressure and the close integration of the creditors in decision making. However, in some aspects they differ significantly: while companies in difficult economic situations mostly try to find a suitable buyer very discreetly, in an insolvency situation, several interested parties are actively approaching the seller because of the publicity of the event. And obviously different insolvency proceedings (ordinary insolvency, insolvency under self-administration) lead to further aspects that the M&A-consultant has to know and consider in the process.

Distressed M&A and Insolvency Situations

What makes us different:

Extremely short time-to-market, very fast processes feasible

Intense partner support throughout the whole process

Professional and efficient coordination of involved parties and consultants

Long-term experience in intercultural transactions

Quick access to potential buyers worldwide through international alliance

Excellent network regarding special situation investors and strategic buyers

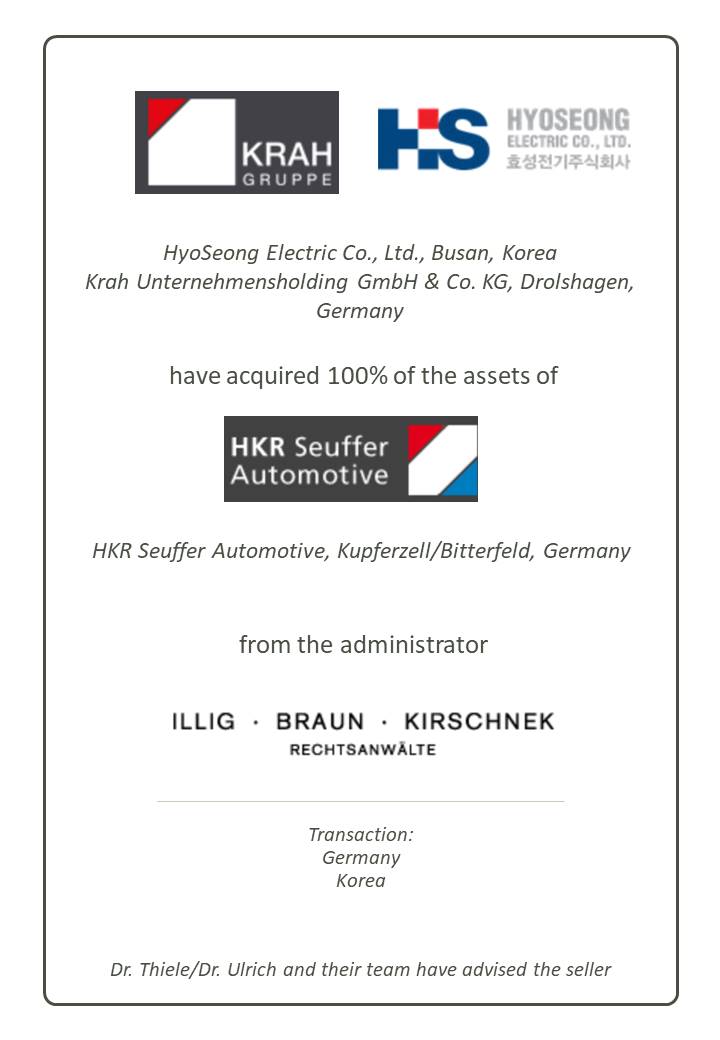

“We have already successfully realised two insolvency transactions together. With their exceptionally high personal commitment and the excellent international network, Dr. Thiele and Dr. Ulrich have significantly contributed to the success of both projects.“

Dr. Tibor Daniel Braun

(Insolvency administrator)

References*:

* Contains reference projects of former occupations of Dr. Thiele/Dr. Ulrich

Distressed M&A and Insolvency Situations

Distressed M&A and insolvency situations have several similarities like generally the high time pressure and the close integration of the creditors in decision making. However, in some aspects they differ significantly: while companies in difficult economic situations mostly try to find a suitable buyer very discreetly, in an insolvency situation, several interested parties are actively approaching the seller because of the publicity of the event. And obviously different insolvency proceedings (ordinary insolvency, insolvency under self-administration) lead to further aspects that the M&A-consultant has to know and consider in the process.

What makes us different:

Extremely short time-to-market, very fast processes feasible

Intense partner support throughout the whole process

Professional and efficient coordination of involved parties and consultants

Long-term experience in intercultural transactions

Quick access to potential buyers worldwide through international alliance

Excellent network regarding special situation investors and strategic buyers

“We have already successfully realised two insolvency transactions together. With their exceptionally high personal commitment and the excellent international network, Dr. Thiele and Dr. Ulrich have significantly contributed to the success of both projects.“

Dr. Tibor Daniel Braun

(Insolvency administrator)

References*:

* Contains reference projects of former occupations of Dr. Thiele/Dr. Ulrich

Distressed M&A and Insolvency Situations